Tax Advantages

Several tax benefits allow your investment to potentially grow faster.

Tax-deferred earnings

Earnings in 529 plans grow tax-deferred. This means all earnings in your account are reinvested, not depleted by taxes.

Tax-free withdrawals

You owe no federal or state income tax on your investment earnings if you spend your withdrawals on qualified higher education expenses.

If you withdraw money for things other than qualified expenses, it will be considered a nonqualified withdrawal. Nonqualified withdrawals will be subject to the following tax consequences:

- Federal income tax on the earnings portion of the withdrawal.

- A 10 percent federal penalty on the earnings portion.

- Utah residents must pay state income tax on the earnings portion.

- Utah residents must add back the amount of a nonqualified withdrawal as income on their Utah state income tax form.

- Consult your tax advisor with questions about whether specific expenses are qualified higher education expenses.

Utah state income tax benefits

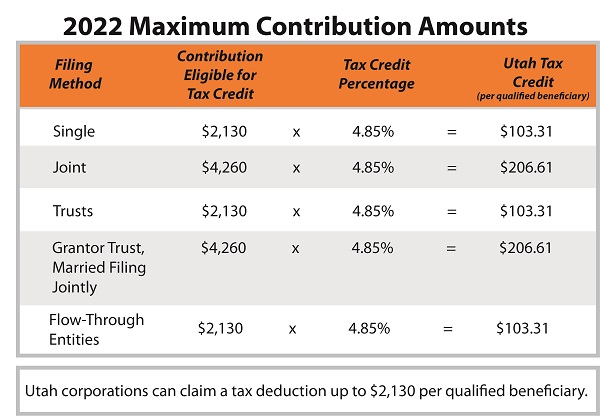

Utah taxpayers may claim a Utah state income tax credit up to certain limits on contributions to their account(s). Utah-based corporations may claim a state income tax deduction up to certain limits. See the table below for the credit you may be qualified for.

To claim the tax credit or deduction:

- The beneficiary must be younger than age 19 when designated on the account.

- If the beneficiary is younger than age 19 when designated, the account owner can claim the credit each year a contribution is made for the life of the account.

Gift tax benefits

A provision of 529 plans allows you to make a lump-sum gift to a beneficiary of up to $80,000 (up to $160,000 if you are married and file a joint tax return) in one year without creating a taxable gift.

You will need to fill out IRS Form 709, which allows the gift to be treated as a series of five equal contributions (e.g., $16,000, if you contribute $80,000; $32,000, if you contribute $160,000, are married, and file a joint return).

Estate tax considerations

Generally, money held in an account is not considered part of the account owner’s estate, even though the account owner remains in control of the money.